Kenya losing Sh684 billion in untapped export earnings, KAM study shows

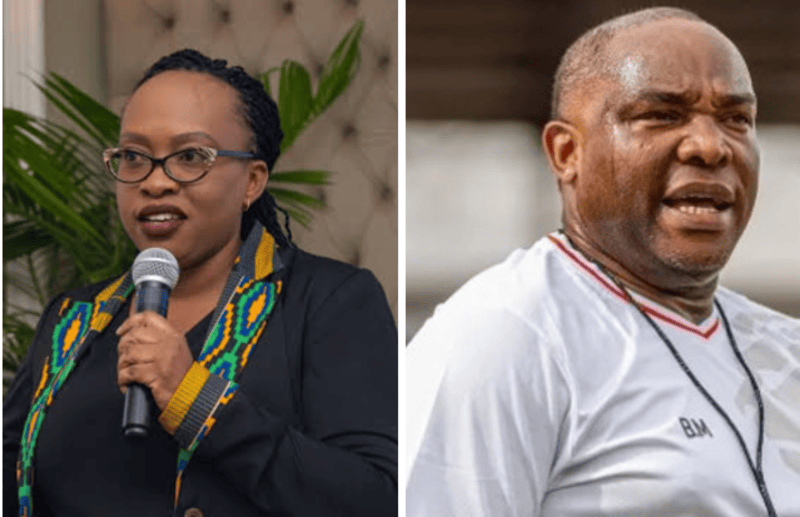

Miriam Bomett, KAM’s head of policy and regulatory advocacy, said the country must address structural and regulatory challenges to close the export gap.

Kenya misses out on Sh684 billion ($5.3 billion) every year in potential export earnings, according to a new industry study, highlighting a growing trade gap as the country continues to import more than it exports.

The study also notes nearly Sh1.3 trillion ($10 billion) in broader export opportunities that remain untapped, while local manufacturers face stiff competition from cheaper imports, particularly from Asia.

More To Read

- Kenya sees major boost from visa-free policy as tourist numbers hit 1.8 million

- KNBS data shows uneven food price shifts as inflation dips slightly

- SMEs sound alarm over rising failure rates amid investment gaps

- How digital platforms are creating new pathways for youth, with riders taking home up to Sh70,000 monthly

- Grade 10 textbook supply at risk as Sh11 billion debt stalls printing

- Busia destroys Sh21.9 million worth of heroin, bhang in anti-drug operation

The Exports Competitiveness Study by the Kenya Association of Manufacturers (KAM), conducted with support from the German Embassy in Nairobi and GIZ Kenya, identifies the East African Community (EAC) and the Common Market for Eastern and Southern Africa (COMESA) as Kenya’s most accessible growth markets.

“Regional markets account for a substantial share of Kenya’s export potential, yet much of this opportunity remains unexploited, with significant unrealised potential in processed food, beverages, construction inputs, pharmaceuticals, plastics and packaging,” the report notes.

Kenya’s exports to the EAC were valued at Sh321 billion last year, with Uganda and Tanzania as the main destinations.

However, exports to COMESA fell by 2.8 per cent, from Sh341.1 billion in 2023 to Sh331.7 billion in 2024, while exports to the wider African region decreased by 2.2 per cent from Sh435 billion to Sh425.6 billion over the same period, according to the Economic Survey 2025.

In total, Kenya’s exports in 2024 reached Sh1.1 trillion, led by tea, coffee, horticultural products, and mineral fuels, driven by demand from Uganda, the UAE, and the United States, even as the expiry of trade incentives like AGOA reshaped trade dynamics.

The country’s trade deficit, however, remained high at Sh1.59 trillion, slightly lower than Sh1.595 trillion in 2023, partly due to reduced food and fuel import costs.

Quarterly data for 2025 shows the deficit widening, with the Kenya National Bureau of Statistics (KNBS) reporting a 76.6 per cent increase in the current account deficit to Sh83.7 billion in the second quarter, compared with Sh47.4 billion in the same period last year.

The merchandise trade deficit alone grew by 11.7 per cent to Sh348.4 billion during this period.

Miriam Bomett, KAM’s head of policy and regulatory advocacy, said the country must address structural and regulatory challenges to close the export gap.

“Kenya’s markets exist, demand exists, but we must strengthen our competitiveness to seize our share. With predictable regulation, stronger value chains and sustained reforms, we can narrow the export deficit and grow our footprint across Africa and globally,” she said.

Bomett added that accelerating reforms, reducing overlapping mandates, and expanding digital trade systems are key to unlocking Kenya’s export potential.

Christoph Zipfel, GIZ Kenya director for sustainable economic development, emphasised value chains as the backbone of competitiveness.

“The study was informed by the need for Kenya to look at opportunities that lie within intra and extra-African trade. It identifies clear opportunities to enhance competitiveness through improved regulatory efficiency, technology adoption and strengthened skills development,” he said.

Top Stories Today